- Published on

Coinbase slammed by CFTC, asked to disclose customer information

- Authors

- Name

- Administrator

- @airdropdecks

Coinbase unexpectedly received a subpoena from the CFTC in its investigation targeting Polymarket, the controversial market prediction platform.

America's leading cryptocurrency exchange, Coinbase, is caught in a regulatory spiral as the Commodity Futures Trading Commission (CFTC) subpoenaed customers in an investigation targeting Polymarket, a market prediction platform based on blockchain technology.

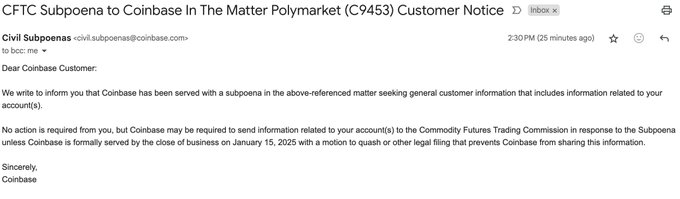

CFTC Subpoena and Coinbase Notification Email

Specifically, the CFTC requires Coinbase to provide “general customer information,” including data related to user accounts.

Immediately, Coinbase sent an email notifying customers of the incident, affirming its commitment to cooperating with authorities but also stressing that it would protect users' privacy.

The email also reassures users that they do not need to take any action and that Coinbase may not be required to submit customer information.

In some cases, we may be required by law to share necessary data that the government lawfully requests. Where necessary, we will seek to narrow down requests that are too broad or vague in order to provide a more appropriate response, and in some cases we object to the provision of any information (such as if the request is not legally qualified).

Polymarket Entangled in Legal Circles

Polymarket, a blockchain application that allows users to predict the outcome of future events, has become the focus of attention during the 2024 US presidential election with a huge volume of transactions, amounting to more than $9 billion.

According to statistics, Polymarket users have spent more than $3.7 billion to bet on this election. The number of active traders on the platform also peaked at 314,500 in December 2024, indicating the heat of the anticipated market and the public's interest in major political events.

However, Polymarket is also in a lot of legal trouble. In 2022, Polymarket had to pay a $1.4 million fine to the CFTC for allegedly offering illegal binary options contracts. The platform also agreed to shut down non-compliant markets and take measures to block U.S. users.

Not to stop there, in November 2024, Polymarket CEO Shayne Coplan had his phone and electronics seized by the FBI. Coplan is now facing a Justice Department investigation into allegations of allowing US users to access the platform.

CFTC beefs up surveillance of anticipatory markets

The CFTC is clearly showing a tough stance on managing the predictive market. Kalshi, one of the few CFTC-approved platforms to operate in the US, has had to go through a protracted legal battle to be allowed to list contracts related to US elections.

Although Polymarket has made efforts to block US users, many still circumvent the law by using VPNs. This poses a major challenge for Polymarket and regulators in controlling the operation of the prediction market.

Aside from legal troubles in the US, Polymarket has also been actively blocking users in France after the country's gaming regulator began reviewing the platform's operations.

Coinbase's receipt of the subpoena indicates that the CFTC is expanding its investigation into Polymarket. The results of this investigation could significantly affect Polymarket's performance in particular and the future of the prediction market in the US as a whole. Can Polymarket weather this legal storm? The answer is still left open.