- Published on

Crypto market drops sharply

- Authors

- Name

- Administrator

- @airdropdecks

The cryptocurrency market has experienced a sharp decline, with the main cause coming from changes in the tax policy of US President Donald Trump. The implications of this decision have left investor sentiment bewildered.

Bitcoin (BTC) saw a deep decline, at one point hitting a low of $96,150, the lowest level in weeks. As of now, the price of BTC is hovering around $97,400, down about 3.7 percent from yesterday. The downward trend stems in part from concerns about Trump's new economic policies, prompting investors to shift capital flows away from riskier assets such as cryptocurrencies.

ETH was also not immune from the negative effects, with a sharp drop to $2,750 before recovering slightly to $2,851. This is a drop of nearly 9.3% over the past 24 hours, reflecting a major correction in the altcoin market amid economic uncertainty.

The sharp decline of BTC and ETH has led to a large-scale liquidation. In the last 12 hours, the total number of orders liquidated across the entire market reached $880 million, of which long orders accounted for the majority with a value of up to $779 million. This suggests that the majority of traders were expecting a bullish trend, but the market went against their predictions, resulting in forced closing of orders.

Not only BTC and ETH, other major altcoins such as XRP, Solana (SOL) and Binance Coin (BNB) also plunged, with declines ranging from 6% to 8%. This suggests that the pessimistic sentiment has spread throughout the market, not limited to large-cap currencies.

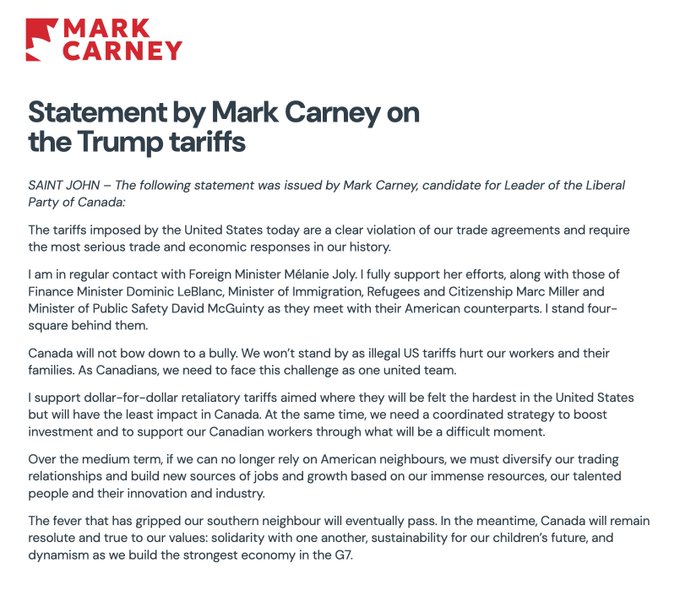

According to analysts, the main reason for the decline is due to information related to Trump's new tax policy. The move to raise tariffs on imports from China, Canada and Mexico has left investors worried about a new trade war, sparking instability in global financial markets. As a result, cash flows out of risky assets such as stocks and cryptocurrencies, moving into safer haven channels.

Shortly after Bitcoin and altcoins tanked, the fear greed index also dropped to 44 after a long stay at the greed level as the price of BTC remained above $100,000.

Despite the influence of macro factors, Bitcoin remained above $96,000, indicating continued support. However, if the economic situation continues to be unstable and the sell-off sentiment persists, the crypto market may still face many challenges in the near future. Investors need to keep a close eye on political developments and make appropriate decisions to manage risk.

Overall, this is one of the strongest corrections of the crypto market in recent times, showing the strong impact of financial policy on the sector.