- Published on

How will the new US tariffs affect the global economy?

- Authors

- Name

- Administrator

- @airdropdecks

As Trump imposes tariffs on goods imported from Canada, Mexico and China, will the decree affect inflation and global economic growth?

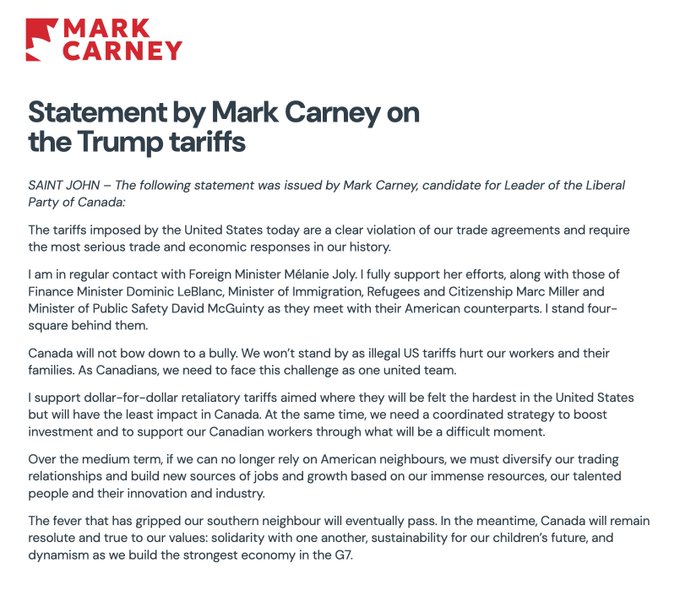

On February 2, 2025, U.S. President Donald Trump surprised financial markets by signing an executive order imposing a 25 percent tariff on most goods imported from Canada, Mexico and China. Energy products are subject to a 10% tariff.

The decision has sparked much controversy and speculation about the economic consequences it could have. The Deer Point Macro account went deep into an analysis of the views on tariffs, providing a detailed and understandable view of the potential impacts of this new policy.

What is the tariff and the mechanism of operation

Tariffs (tariff), in essence, are a tax that is imposed on imported goods. When a country applies tariffs, the cost of foreign goods increases compared to those produced domestically. The main purposes of the application of tariffs include:

- Protection of domestic industry:Tariffs help domestic businesses relieve competitive pressure from imported goods, especially infant industries. By raising the price of imports, tariffs create a fairer “playing field” for domestic businesses, giving them the time and resources to grow and compete more effectively.

- Promoting domestic production:By making imported goods more expensive, tariffs encourage consumers to prioritize their choice of domestically produced goods, which in turn promotes economic growth and job creation. This is especially important for developing countries, where building a strong industry is an important goal.

- Increase revenue for the state budget: Tariffs are an important source of revenue for the government, helping to increase the budget for spending on public activities, such as investment in infrastructure, education, health, and social welfare programs.

For example, if the US government increases tariffs on imported electronics, the cost of these products (such as phones, computers, televisions) will increase. This could reduce the price difference between imports and domestically produced goods, making domestic goods more attractive to U.S. consumers.

Economic theory of tariffs

The economic theory of tariffs focuses on analyzing their effects on free trade, both positive and negative.

Positive Impact:

- Domestic Enterprise Protection: As mentioned above, tariffs help domestic enterprises better compete with imported goods, especially in the early stages of development.

- Job creation: As domestic industries grow thanks to tariffs, the demand for labor increases, which in turn creates more jobs for the population.

- Increase revenue for the government: Tariffs are an important source of revenue for the state budget, giving the government more resources to spend on public activities.

Negative impact:

- Reduced economic efficiency: Tariffs reduce market competitiveness, resulting in inefficient allocation of resources. Domestic enterprises can become less dynamic and less innovative due to not being under competitive pressure from abroad.

- Increase in commodity prices: Tariffs make imported goods more expensive, directly affecting consumers. Consumers pay higher prices for goods, which reduces their purchasing power.

- Trade wars: Tariffs can lead to trade wars between countries, as countries retaliate against each other by imposing their own tariffs. This harms all stakeholders, disrupts global supply chains and reduces economic growth.

For example, if the U.S. imposes tariffs on imported steel, companies that make cars, equipment or construction that use steel would see their production costs rise. To maintain profits, these companies can raise product prices, which can eventually lead to inflationary pressures in the economy, i.e. higher prices for goods and services.

Tariffs in practice

The relationship between tariffs and exchange rates

In fact, the impact of tariffs is much more complex than in theory. The relationship between tariffs and the nominal effective exchange rate (NEER) is a good example. NEER is an indicator that measures the value of a currency against a basket of other currencies.

In the short term, there is a close relationship between tariffs and NEER, but in the long term, other factors (such as interest rates, economic growth, monetary policy) begin to affect the NEER, reducing the impact of tariffs.

Impact of tariffs on common prices

The study also shows that the impact of tariffs on the overall price level is usually very small, if any. In fact, many factors, such as exchange rate fluctuations, often compensate for the expected increase in tax rates.

For example, when tariffs rise, one of the immediate reactions in the global economy is the potential volatility of exchange rates. If the U.S. imposes higher tariffs, this could lead to a stronger U.S. dollar as traders anticipate reduced trade flows. A strong dollar could mitigate tariff-induced price gains, because imports become cheaper in U.S. dollars.

Impact of Tariffs on Personal Consumption Expenditure (PCE)

The impact of tariffs on Personal Consumption Expenditures (PCE) is also small. PCE is an indicator that measures the total expenditure of households on goods and services.

Even if tariffs are imposed, they account for only a very small part of total consumer spending. The correlation between tariffs and PCE is often weak or negative, suggesting that tariffs do not significantly affect overall consumer spending.

However, in certain circumstances, tariffs can be useful, such as during the COVID-19 pandemic, which helped encourage domestic production capacity building and played a role in normalizing the supply chain.

As global supply chains are disrupted by the pandemic, countries recognize the importance of having domestic production capacity for essential items. Tariffs can be used to encourage businesses to invest in domestic production, reducing dependence on imports.

Impact of tariffs on Canada and Mexico

The imposition of tariffs on Canada and Mexico could have serious economic consequences for both countries, given their large trade dependence on the United States. The expected retaliatory measures, together with the volatility of the currency, will aggravate the situation. The Canadian dollar and the Mexican peso are likely to depreciate against the U.S. dollar, further straining the economies of the two countries.

The devaluation of the currency could significantly increase domestic prices in Canada and Mexico, contributing to rising inflation. This could force Canada to cut interest rates to support domestic demand, while Mexico may have to raise rates to control inflation, although this could slow economic growth.

Global Financial Markets After U.S. Tariff Decree Signed

Although it did not directly affect inflation and global economic growth, the news of the imposition of the tariff decree was perceived by the markets as negative news, affecting investors' sentiment about a more positive financial world after the president-elect took office. This creates a domino effect, causing Bitcoin and other risky assets to continue to fall in price.

Specifically, shortly after the decree was announced, the cryptocurrency market witnessed a sharp sell-off. The price of Bitcoin (BTC) fell deeply, at one point hitting a low of $91,550, the lowest level in weeks.

As of now, BTC is hovering around $95,400, down about 4.7% from the previous day. Other cryptocurrencies such as ETH, XRP and SOL were also heavily affected, falling by 10-15%.

U.S. stock markets are also expected to have a volatile session following President Trump's announcement of tariffs. U.S. stock futures collectively fell sharply, with the Nasdaq down 2.35 percent and the S&P 500 down 1.8 percent.

U.S. crude oil prices rose more than $2 when trading in Asia began on Feb. 3, while gasoline prices rose more than 3 percent.

The impact of tariffs on the economy is more complex than we think. While tariffs can raise prices in certain areas, their overall impact on inflation is often limited.

There are many factors that influence this, including exchange rate fluctuations (for example, a stronger U.S. dollar can offset rising prices due to tariffs), adjustments in the global supply chain (countries can source goods from other markets), and domestic production growth.

Sometimes, as during the COVID-19 pandemic, tariffs can also boost domestic production and strengthen the resilience of the supply chain.

However, the impact of tariffs is not always the same. Countries such as Canada and Mexico, which could be hit harder by U.S. tariffs due to dependence on supply chains and currency volatility, which in turn continue to impact financial markets.