- Published on

Over $2 billion Solana from FTX is about to be unlocked

- Authors

- Name

- Administrator

- @airdropdecks

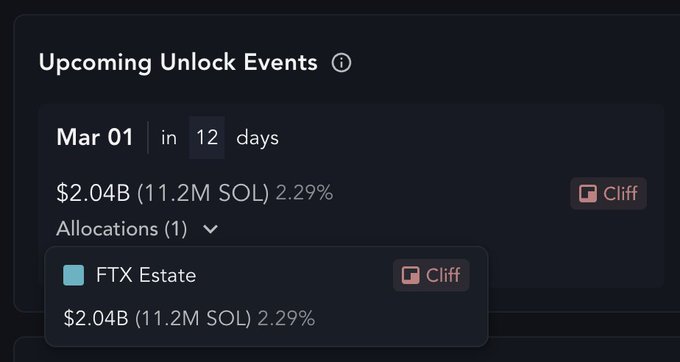

On March 1, 11.2 million SOL from FTX will be unlocked. Will it put additional selling pressure, or will this be an opportunity for Solana to prove its endurance?

The crypto market is interested in the event that Solana (SOL) is preparing to unlock a large amount of tokens. Specifically, 11.2 million SOL tokens from the bankruptcy of the FTX exchange will be unlocked on March 1, 2025, with an estimated total value of up to $2.06 billion.

Earlier, FTX auctioned 41 million SOLs across three batches, priced at $64, 95 and $102, respectively. Institutional investors such as Galaxy, Pantera, Figure and many other names participated in these auctions.

Unlocking such a large amount of SOL tokens can cause significant impacts on the value of the coin. On the one hand, having more tokens on the market can increase supply, thereby putting downward pressure on prices. On the other hand, this event can also grab investors' attention, create buying force and push prices higher.

The timing of the token unlock is quite sensitive, when the SOL price is struggling. The coin has fallen nearly 13% over the past 30 days, hovering below the $200 threshold. Although SOL has had strong growth in the past, current technical indicators show that the downtrend still prevails.

In addition, Solana also faces many other challenges, including controversies related to meme coins and allegations of fraud.

Following the launch of LIBRA, the controversial meme coin promoted by Argentine president Javier Milei, many users questioned the transparency of some Solana applications. The community is also concerned about the possibility that this blockchain has reached a peak in terms of acceptance and value.

In addition, some users and artists in the community have voiced criticism of projects such as Jupiter, Meteora and Pumpfun, claiming that these projects are taking advantage of users through scams.

Although Solana has faced criticism, some members of the Solana community argue that the high number of scams is an inevitable consequence of Solana's size and growth. He argues that having more users will attract bad guys, similar to what has happened in other large blockchain ecosystems.

Data from DeFilama shows that weekly trading volume on Solana's decentralized exchanges (DEXs) has declined continuously for five weeks. While trading volume on Solana decreased, Binance Smart Chain (BSC) increased. This suggests a shift in cash flow between blockchain ecosystems.

Solana's upcoming big token unlock event could bring both opportunity and risk. The market will need time to absorb this amount of new tokens and assess its impact on the value of SOL. In addition, Solana also needs to address the challenges associated with meme coins and alleged scams in order to maintain the trust of the community and attract more users.