- Published on

The impetus for Ethereum to “break through” in 2025

- Authors

- Name

- Administrator

- @airdropdecks

Ethereum continues to assert its position as the leading blockchain platform in the decentralized cryptocurrency and finance (DeFi) space. In 2024, Ethereum has achieved many remarkable milestones, from technological improvements to growth in the number of people

Ethereum milestone in 2024

Dencun Upgrade: Leap in Scalability

Upgrade Deneb-Cancun (Dencun), deployed on the Ethereum main network in March 2024, is an important step in the journey to improve the network's scalability. The highlight of this upgrade is Proto-Danksharding (EIP-4844), an intermediary solution towards complete sharding — a method of breaking down the Ethereum network into smaller units (shards) to reduce data storage costs and improve performance.

Proto-Danksharding, proposed by the two researchers Protolambda and Dankrad, not only laid the foundation for Danksharding but also served as an important milestone in the expansion of the Ethereum network's processing capabilities.

Proto-Danksharding introduces a new type of transaction called a blob-carrying transaction, which allows the attachment of large blob data (about 125 kB) at a much lower cost than traditional calldata. This is an essential improvement, as current calldata on Ethereum is very expensive due to high demand, forcing rollup solutions to compete fiercely with other transactions for network resources.

With blobs, this data will be stored separately and no longer compete with conventional transactions, greatly reducing the work required to maintain data on the network, thereby increasing processing speed and reducing transaction costs.

Furthermore, the Dencun upgrade also creates two separate fee markets: one for the main execution layer (L1) and one for data blobs. This opens up more efficient data storage space for rollup solutions, enhancing Ethereum's overall scalability.

After the upgrade, average gas charges dropped sharply from 98 Gwei to below 10 Gwei, with the lowest recorded at just 1 Gwei. This is an important step forward, making Ethereum more user-friendly, while facilitating the development of decentralized applications (dApps) and layer 2 solutions.

Ethereum ETF: Bridge to the traditional investor

July 2024 marks the launch of the Ethereum ETF, opening up opportunities for traditional investors to access ETH easily and legally compliant. This ETF not only helps increase liquidity, but also promotes the adoption of blockchain technology in financial institutions.

Ethereum ETFs offer an indirect way to invest in Ethereum without buying or storing cryptocurrencies, suitable for investors who are unfamiliar with cryptocurrencies or who prefer tighter security and regulation.

There are two main types of spot ETFs, which track the price of Ethereum directly, and futures ETFs, which track the price of Ethereum futures contracts. This product has many advantages, such as accessibility, manageability, portfolio diversification and high liquidity. However, they also carry risks such as market volatility, high costs, legal risks and a limited operating history.

Since its launch, the number of daily transactions on Ethereum has increased by more than 15%, and the number of active users exceeded 500,000 people/day during peak periods.

Currently, the legal status of Ethereum ETFs is heterogeneous globally: Canada and Australia have approved spot ETFs, while the US only accepts futures ETFs. In addition to ETFs, investors can consider other options such as investing directly in cryptocurrencies, Grayscale Trusts, blockchain stocks, or blockchain-related ETFs.

The future of Ethereum ETFs depends on the evolution of regulatory regulation, market sentiment, and technological advancements in the Ethereum network.

Devcon 7: Affirming the Ethereum community spirit

Devcon 7, held in Bangkok, is the largest event in Ethereum history, attracting more than 12,000 attendees from around the world. With more than 1,000 events on the sidelines, Devcon 7 is not only a place to share knowledge, but also a stage for Vitalik Buterin and developers to present Ethereum's future orientation. This event demonstrates the spirit of collaboration, creativity and commitment to building a more inclusive Web3 ecosystem.

A familiar highlight at Devcon is Vitalik Buterin's keynote speech, “Ethereum in 30 minutes,” which has been presented continuously since 2014. The 2024 speech highlights Ethereum's transformation over time, from eliminating old problems like uncle blocks, to focusing on new challenges and opportunities like layer 2.

Justin Drake, a researcher at the Ethereum Foundation, also introduced innovative proposals such as MEV burn, pre-confirmations, and a redesign of the consensus layer to Beam Chain, reflecting the ongoing evolution of the Ethereum network.

In addition to innovative ideas, Devcon 7 is also an occasion to look back at key metrics shaping Ethereum in 2024, showing Ethereum's strength and sustainability in a thriving decentralized financial ecosystem.

The growth of Ethereum through the numbers

The number of Ethereum wallet addresses has maintained a steady growth momentum since the network's launch in 2015. 2024 marks a period of linear development, without sudden fluctuations, demonstrating the maturity and stability of the Ethereum ecosystem. Notable figures for the year include:

- Total growth: 39.6 million new addresses (+15.76%).

- Average daily growth: 108,200 addresses.

- Peak growth date: 213,228 new addresses on May 4, 2024.

The number of daily active users on Ethereum ranged from 300,000 to 400,000 throughout 2024, with some peaking above 500,000 during key events such as network upgrades in June and the launch of the Ethereum ETF in July.

The daily trading volume on Ethereum remains at a stable level, reflecting the constant rhythm of the network's activity. The number of transactions ranged from 1.03 million to 1.2 million, with the daily average reaching 1,164,911 trades. Compared to 2023, the average trading volume increased by 11.83%.

The highest trading day of the year, January 14, 2024, reached 1,961,144 transactions, mainly thanks to the strong activity of the “whales”. In contrast, the lowest trading day, October 27, 2024, recorded 965,098 transactions, coinciding with the end of a bearish period before the market recovered. The highest trading peak in 2024 also exceeded the 2023 high of 20.47%, or 333,284 more trades.

These numbers demonstrate the sustainable development and relentless appeal of Ethereum, affirming the critical role of the network in the global blockchain ecosystem.

Ethereum: Staking, Liquid Staking and Liquid Restaking

2024 marks a steady growth in Ethereum staking activity, with the amount of ETH staked continuing to rise steadily and outpacing the number of ETH withdrawn. Unlike 2023, when the Shapella upgrade triggered a spike in growth thanks to the possibility of ETH withdrawals, 2024 reflects the maturity of investors, with long-term decisions and less dependence on price movements.

As of December 1, 2024, the total number of ETH staked reached 34.37 million, an increase of 6.13 million ETH (+21.71%) over the previous year. Although the growth rate is somewhat reduced compared to previous years, this slowdown is the result of:

- The possibility of ETH withdrawal after the Shapella upgrade (4/2023) makes ETH stake growth more balanced.

- The total size of ETH staking has been much larger, reducing the relative growth rate.

- The validator activation limit is reduced from 16 to 8 per epoch, through the Dencun upgrade, to ensure network security.

In retrospect, major improvements such as The Merge (2022) and Shapella (2023) upgrades have generated huge bursts of growth in Ethereum's staking history.

The percentage of ETH staked increased to 28.54%, with liquid staking accounting for almost a third of all ETH staked, thanks to the flexibility that does not require a key capital of 32 ETH. However, this form also comes with risks:

- Risk of devaluation:Staking tokens can be devalued compared to the original ETH.

- Risks of centralization: Large platforms can unbalance the network.

- Security risk:The smart contracts involved can be faulty or hacked.

Liquid restaking, a new form of staking, already accounts for nearly 7% of total ETH stake, which offers great potential but also comes with additional technical risks.

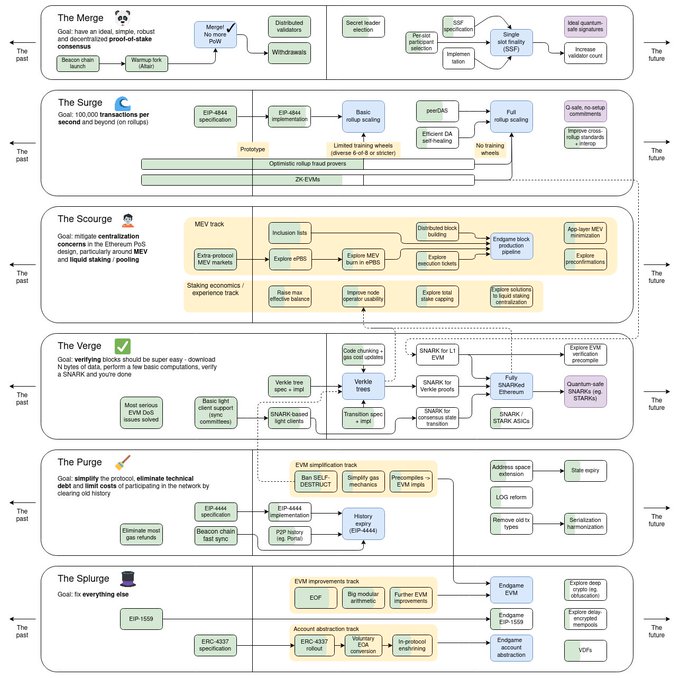

Ethereum 2025 Forecast: Pectra Upgrade and New Directions

Pectra Upgrade

2025 is expected to bring many major changes with the Pectra upgrade, which promises to improve Ethereum's performance and scalability:

- Staking improvements: The process of depositing and withdrawing ETH is simplified, combined with updates in authentication activation and exit, providing a more user-friendly experience.

- Improving user experience (UX): Better support for wallet developers and dApps interaction, making the experience smoother and more intuitive.

- Network Performance:Reduces operational complexity and increases Ethereum's ability to maintain performance even during periods of high load.

Currently, the Pectra upgrade is being tested on the Mekong testnet, where core developers, application builders, operators and staking participants can test changes and prepare for deployment on the main network.

After test on the MekongFinally, Pectra will continue to be tested on public testnets such as Sepolia and Holešky. This step-by-step testing process allows Ethereum developers to detect and fix the problem before it is formally applied on the main network.

Although there is no specific date yet, Pectra is expected to be deployed on the main network in early 2025, bringing significant changes to the Ethereum ecosystem.

Shared Security: The restaking game changer on Ethereum

Shared security is a pioneering model in optimizing security and interoperability between blockchains. Through restaking, blockchains can leverage existing teams of validators without building large communities to ensure security, greatly reducing security costs, and opening up access opportunities for small projects.

Restaking also allows staking participants to reuse their staked assets across multiple protocols simultaneously, optimizing capital efficiency and bringing lower security costs for new blockchains on Ethereum. Projects like Symbiotic have led the trend by providing decentralized protocols that allow custom networks to implement restaking, fostering a more tightly connected blockchain ecosystem.

The adoption of this model not only reduces cost and complexity, but also helps new networks inherit strong security from Ethereum without having to build from scratch, creating a more collaborative and cohesive blockchain environment.

Pre-confirmations: Improve trading reliability

Preconfirmations (Preconfs) is a new mechanism in the Ethereum ecosystem, providing almost instant transaction confirmation with a latency of just 100ms. This mechanism solves the problem of delays and uncertainty in trading by allowing the block proposer to commit to processing the transaction on time, in return for rewards from the user.

Preconfs, along with platforms such as EigenLayer and Symbiotic, brings Ethereum closer to real-time trading, increasing competitiveness and attracting global users. The Primev project is leading the way in the application of this technology, which improves the efficiency of interaction on the network.

2024 is a year of strong transformation of Ethereum, marking technological and community maturity. Innovations like Dencun, the launch of ETFs, and major events like Devcon 7 have solidified Ethereum's position as the leading blockchain platform. With upgrades being rolled out, Ethereum promises to not only meet current demand but also open up the future for billions of users around the globe.