- Published on

Trump reverses policy, US poised to enter crypto's golden era

- Authors

- Name

- Administrator

- @airdropdecks

Less than 72 hours before Donald Trump officially takes office as US President, the crypto market is awash with expectations of a series of important policy changes that could shape the industry's future in the coming years.

After four years of tightening under the Biden administration, the crypto industry is witnessing a dramatic policy reversal as Donald Trump nears office.

Investors and crypto advocates called this “the end of four years of terror,” and expect a period of explosive development with a series of policies that benefit the industry.

Trump is laying the groundwork for this shift by appointing crypto-friendly officials, such as David Sacks as “czar” in charge of AI and crypto, and nominating Paul Atkins as SEC chairman.

According to multiple sources, as early as his first day in the White House (Jan. 20), Trump is expected to sign a series of executive orders aimed at supporting crypto, including ending the debanking policy, establishing a national Bitcoin reserve, and requiring regulators to cooperate with the industry instead of suppressing it.

The change is especially significant because over the years, the Biden administration has imposed many harsh regulations on the crypto industry, forcing banks to refuse to cooperate with crypto companies, prompting many startups to leave the United States.

Nic Carter, a veteran crypto investor, called this “Operation Chokepoint 2.0,” a similar crackdown that took place under Obama.

Marc Andreessen, one of the leading venture capitalists, described the Biden administration's approach as financial terrorism, in which dozens of startups he invested in were “debanked” by banks for no apparent reason.

This has left many crypto projects unable to operate in the US, forcing them to look to other markets such as Singapore, Dubai or Europe. With the change of government, however, these companies are intent on returning to the United States.

The founders are looking to return or first expand to the US after four years. This is evident in the fact that large projects such as TON are expanding into the US market.

According to Carter, as long as Trump ends the debanking policy, the U.S. crypto industry could enter a renaissance, as startups turn around and investment flows in stronger.

Not only stopping at opening the door to the industry, Trump is also expected to sign an executive order directing the SEC to suspend crypto-related lawsuits, especially those without elements of fraud. According to Stuart Alderoty, chief counsel for Ripple Labs, the lawsuit between the SEC and Ripple could be dropped altogether under the new administration.

In addition, the decree could also include the establishment of a national Bitcoin stockpile, marking the first time the United States officially holds crypto on the government's financial balance sheet.

The most controversial, however, is the plan to put US-issued cryptocurrencies into the national reserve, including Solana (SOL), USD Coin (USDC) and Ripple's XRP. Over the past time, Trump has met with many founders of major crypto projects and is said to be very open to the idea.

However, this has led the Bitcoin community to worry that BTC could lose its dominance if the US government prioritizes US-derived altcoins. Brad Garlinghouse, CEO of Ripple, has actively campaigned for XRP to be included on the list. But according to the New York Times, there is no official confirmation from Trump about agreeing to the proposal.

Rumors of the plan alone caused XRP's price to rise 10 percent to $3.40, a seven-year high, while SOL also rose 5 percent to $213.

Data from CoinGecko shows that XRP is one of the tokens with the largest trading volume in the last 24 hours, with $2 billion on Coinbase and $3.8 billion on Binance.

Julio Moreno, research expert at CryptoQuant, noted that the number of XRP wallets active daily has increased from 10,000 wallets in mid-2024 to 100,000 wallets by the end of the year, indicating strong market interest. XRPL's DEX liquidity has also quadrupled, reaching $20 billion.

But not everyone believes this rumor. Unchained, a crypto news site, quoted several sources as saying that this may just be a media campaign created by Ripple to push up the price of the token. When asked about the matter, a Ripple spokesperson declined to confirm, but did not deny it outright either.

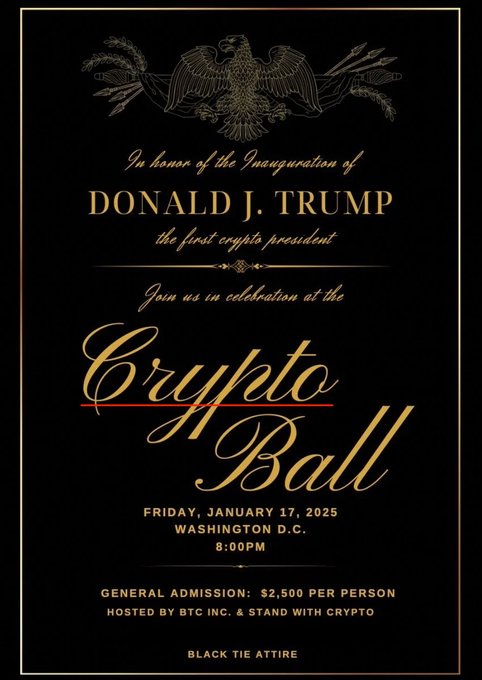

As the crypto market is buzzing with upcoming policy changes, David Sacks will host the Crypto Ball, a VIP event dedicated to the crypto community in Washington, D.C., on Jan. 19.

The event brought together the greats of Coinbase, Solana, MicroStrategy, Kraken and Galaxy Digital, with Snoop Dogg in attendance. Admission tickets range from $2,500 to $1 million, where the VIP package includes a private dinner with Trump.

Clearly, the crypto industry is expecting a lot from the Trump administration. If Trump actually makes good on his commitments, the US could become a global crypto hub, rather than letting other markets like Dubai, Singapore or Hong Kong take the lead.

Anthony Pompliano, founder of Professional Capital Management, believes Trump will push for changes in accounting and regulatory regulation, making crypto more easily accepted in the traditional financial system.

Although there is much controversy and no certainty yet, the optimism of the crypto market is undeniable. If the decree is signed on January 20, it would be the biggest turning point for the crypto industry in years, ushering in a new era for Bitcoin and digital assets in the US.