- Published on

U.S. Government Sells $6.5 Billion in Bitcoin, Should We Panic?

- Authors

- Name

- Administrator

- @airdropdecks

Tens of thousands of Bitcoins from the notorious Silk Road black market are about to be “flushed” into the market. What awaits cryptocurrency investors?

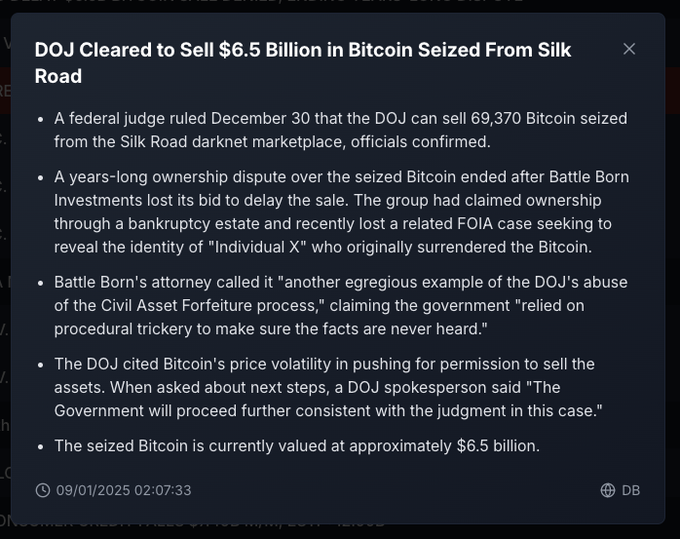

On January 9, the U.S. Department of Justice (DOJ) was officially authorized by a federal court to sell 69,370 Bitcoins, which equates to a current market value of $6.5 billion.

The decision was made on December 30 by the Northern District Court of California, which allowed the DOJ to convert all of these bitcoins into dollars.

Bitcoin Digital Origins and Lengthy Legal Battle

The massive amount of Bitcoin has its origins in Silk Road, a notorious online black market that was dismantled by the FBI in 2013. Ross Ulbricht, the founder of Silk Road, is serving a life sentence for charges related to the website's operation.

After Silk Road was shut down, billions of dollars worth of Bitcoins were confiscated by the US government. However, who is the rightful owner of these bitcoins has become the subject of protracted legal dispute.

Battle Born Investments, the investment firm, claimed ownership of the bitcoin through a bankruptcy case involving Raymond Ngan, who allegedly stole Bitcoin from Silk Road.

The legal battle between Battle Born Investments and the DOJ has dragged on for years, with multiple appeals and requests for information. However, the U.S. Supreme Court ultimately refused to consider Battle Born Investments' appeal, paving the way for the DOJ to liquidate the bitcoin.

Reacting to the ruling, Battle Born's lawyers sharply criticized the DOJ, accusing them of “abusing the civil asset seizure process” and “using procedural tricks” to gain an advantage in the case.

Reasons to Sell Bitcoin and Concerns

The Bitcoin liquidation is expected to be one of the largest ever crypto liquidations by the US government.

The DOJ justified the decision to sell Bitcoin by citing concerns about Bitcoin's price volatility and the risk of loss of value if the asset is held for too long. A DOJ spokesperson said it would make the sale in accordance with the court's ruling.

The timing of the Bitcoin liquidation has not been announced, but the ruling does not mean immediate liquidation of the seized Bitcoins, as the federal asset confiscation process requires a number of administrative procedures.

Although the DOJ typically sells foreclosed assets in small batches to minimize the impact on the market, the sheer scale of these transactions can still cause certain volatility. Selling large amounts of Bitcoin at the same time can increase supply, thereby putting downward pressure on the market.

Some speculation surrounding the sale of Bitcoin

The incident drew particular attention because it took place just days before the new administration, headed by President-elect Donald Trump, officially took office. Mr. Trump pledged during his presidential campaign that he would not sell any Bitcoins held by the government.

This approach would apply to all seized cryptocurrencies, including 69,370 Bitcoins from Silk Road (if the liquidation period occurred after Donald Trump's election).

Although the ruling was handed down on December 30, it remains unclear why documents relating to the seized bitcoins were released this week.

Some have suggested that the sale of Bitcoin may be an attempt by the Biden administration to stifle Bitcoin's growth, or even a market manipulation ploy. A government sell-off of large amounts of Bitcoin could create downward pressure and destabilize the market.

The fact that the US government could sell large amounts of Bitcoin caused a sell-off in the market. Bitcoin's price fell from $95,500 to $93,100, which equates to a drop of about 2.5 percent. This decline is not only limited to Bitcoin, but also entails the weakening of many other cryptocurrencies.