- Published on

Bitcoin drops to $95,000 post-Christmas

- Authors

- Name

- Administrator

- @airdropdecks

Interest rates have always been the driving force behind Bitcoin's growth for much of 2024, but could now become a stumbling block.

As the whole world was celebrating the Christmas holiday, Bitcoin was quietly climbing into the $100,000 zone after a sudden drop below $93,000 just before the holiday.

However, the rally only stopped at $99,800 when Asian markets opened trading on Thursday morning, December 26, and quickly turned back towards the 95,000 zone after just a few hours.

At the time of writing, Bitcoin is trading at $96,150, down 3.8 percent from its intraday high at $99,960.

Other major currencies such as ETH, SOL, XRP, ADA and AVAX all fell in price on Dec. 26, losing between 4% and 7%.

Meanwhile, TOTAL3, an index that represents the total crypto market capitalization minus BTC and ETH, evaporated by more than 4%, equivalent to more than $40 billion, during the day.

The US market is now open, but has not seen much volatility. Stock indices show that the market is now slightly down, while gold and oil prices are up slightly.

While Bitcoin has more than doubled in 2024, recent declines could be a sign that low interest rates in the United States are a stumbling block on the coin's path to growth.

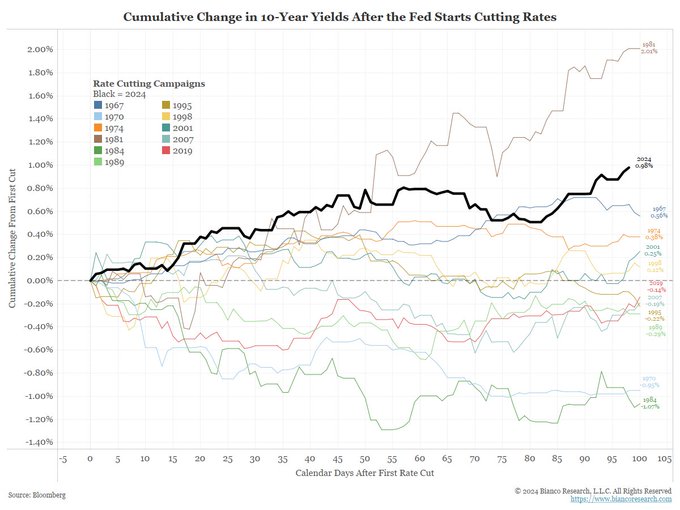

The yield on 10-year Treasury bonds continued to rise early Thursday, now at 4.63 percent and just a few basis points away from the 2024 high. Yields have now risen nearly 100 basis points since the Federal Reserve (BOLD) cut short-term interest rates by 50 basis points in September.

Macro researcher Jim Bianco noted that the rapid rise in bond yields immediately after the Fed cut interest rates is almost unprecedented in history.

The bond market will continue to sell at higher yields as the Fed continues to talk about cutting interest rates in 2025.

Jim said if the Fed did not restrain its intention to cut interest rates, bond yields would rise so high that it would start breaking things up with the aim of beating inflation.